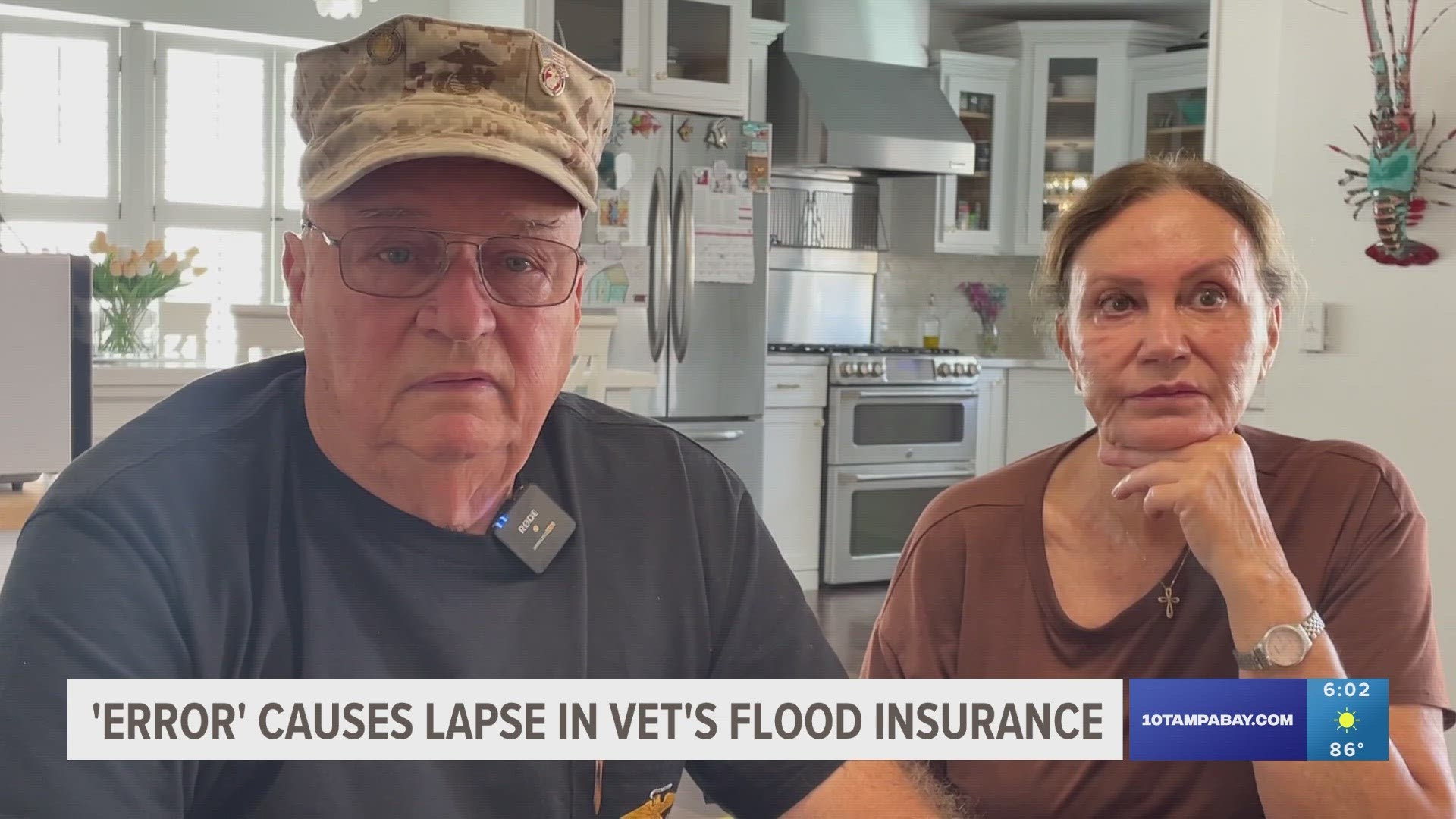

HUDSON, Fla. — More than six months after Hurricane Idalia made landfall causing damage along Florida’s Gulf Coast, the insurance woes continue for a Pasco County veteran and his wife who say his home did not have flood coverage because of an error during the transfer of his mortgage.

After an estimated $100,000 worth of repairs, John and Rosemarie Gregory are back inside their Hudson home. The couple says they were staying in short-term rentals and other areas for months after flooding from Idalia caused extensive water damage.

RELATED: Vietnam veteran says insurance company won't pay up after he and his wife were displaced by Idalia

"About the worst thing that can happen to anybody. You know, especially at our age very, very hard. Just heartbreaking,” Rosemarie Gregory said.

John Gregory, a Marine, added, “It's just been a nightmare from start to finish. And with no help at all from the insurance company except telling us, 'Sorry, see you later.'”

The Gregorys say a family member helped take care of the rebuild because their flood insurance company, National General, or who they thought covered their flood insurance, didn’t accept their claim.

Back in November, 10 Tampa Bay first interviewed John Gregory, who said he thought his home was covered with a flood policy active from June 2023 through June 2024, paid through his escrow account.

“Everything was good, which is the same thing my mortgage companies telling us,” John Gregory explained.

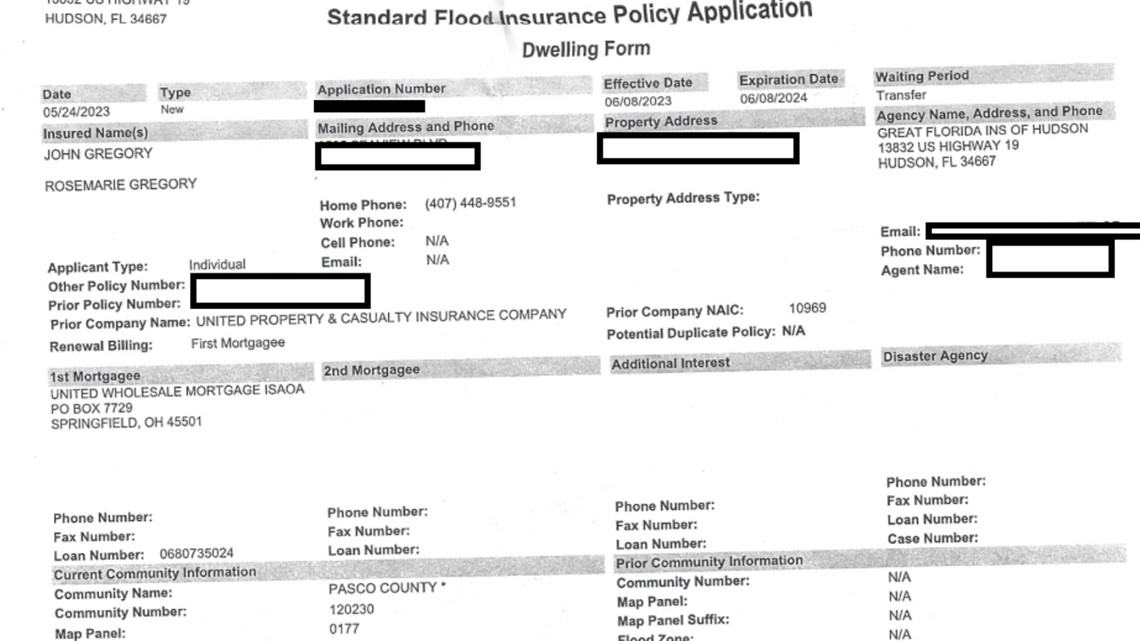

He filed a complaint with the state in the Office of Financial Regulation to review his lender. Carrington says the original lender United Wholesale Mortgage received a policy from National General on June 9 and sent the application, but it was not validated.

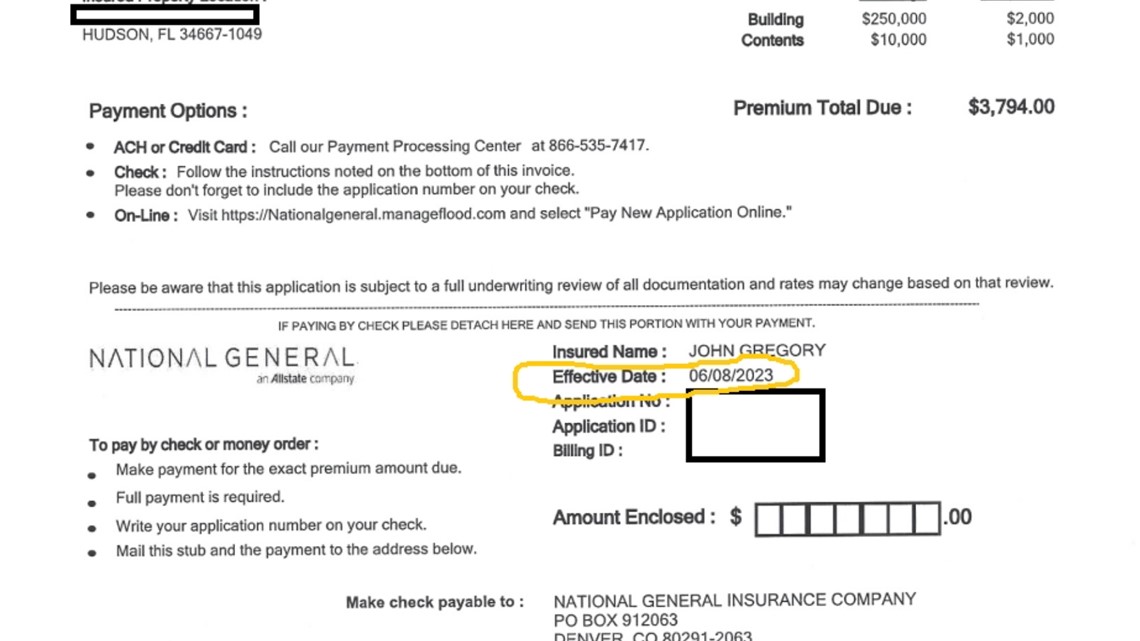

When Carrington took over the mortgage, they claimed they received a new application invoice for the policy term of June 2023 to June 2024.

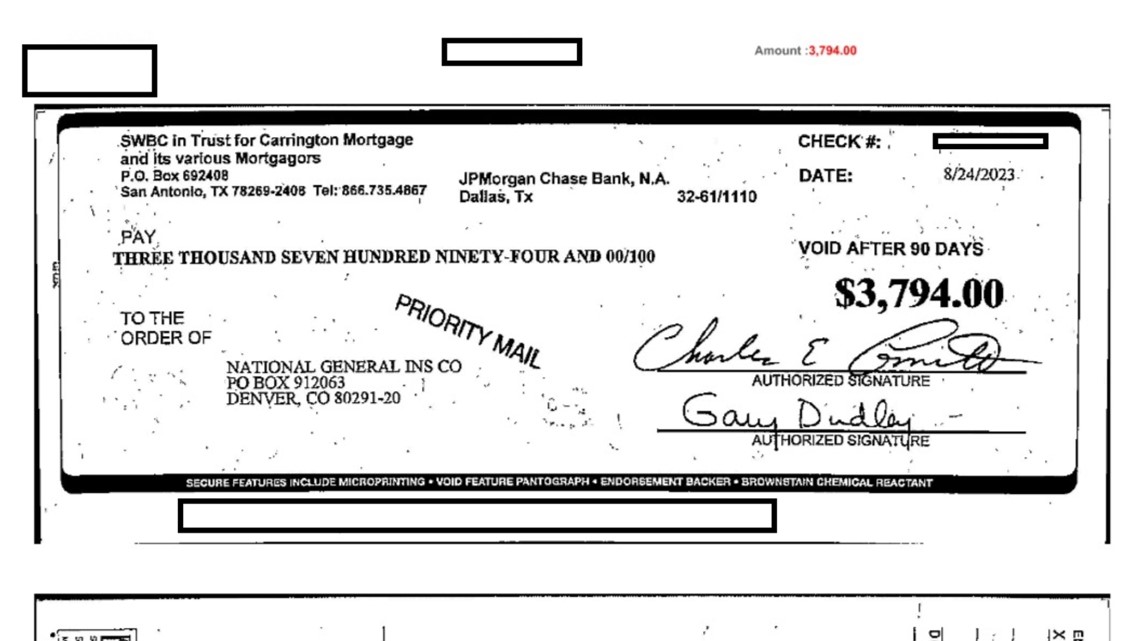

In their response to the state, a representative from Carrington says they called National General several times over a few days to verify the policy was active and/or if more payment was due. On Aug. 23, the insurer responded requesting an overnight premium payment of more than $3,700, the amount listed on the application.

Their records show the check they sent was cashed on Aug. 28, Idalia flooded the area two days later.

“They've got a copy of where they received, where they cashed it and they're still saying that we're not covered,” John Gregory said.

Now months later, new information has been revealed on what may have led to the Gregorys renewal falling through the cracks.

In emails obtained by 10 Tampa Bay, UWM’s Director of Consumers Affairs Tim Link confirmed an error by their third-party insurance vendor caused the renewal to not process earlier in the year.

“We have received additional information from our third party insurance vendor Assurant. They have confirmed that a processing error caused them to not renew Mr. Gregory’s flood insurance policy and that they did, in fact, have information sufficient to process the renewal in June of 2023. Due to the error by Assurant, we have instructed our Servicing Team and Assurant to work with Mr. Gregory’s insurance company and Carrington to ensure he is able to obtain new coverage, including a possible reimbursement of a portion of his new premium,” Link wrote to Jim McKinnell Jr., a financial specialist with the Florida Office of Financial Regulation.

The lender also issued a refund of $1,510, to in part, pay for the increased insurance premium the Gregorys received due to the lapse in coverage.

“I am currently in the process of having a check in the amount of $1,510.00 issued to your father, consisting of the $184.00 in forced place premium retained by Assurant prior to the transfer to Carrington, as well as the $1,326.00 he paid for the increased premium,” Link wrote to the Gregorys son-in law.

As for the damages done in the flood, the company says they are not responsible for those costs, because John Gregory didn’t report the damage to his mortgage company.

“In regards to the requirement that your father inform Carrington of the damage to his property, this is a requirement contained in Section 5 of the Mortgage he executed. If Carrington had been notified of the damage to the property, contact would have been made with your father’s insurance company and, based on their refusal to provide coverage during this alleged grace period, an additional forced place policy could have been purchased to ensure there was coverage to repair the damage.

"Furthermore, I have been unable to locate any federal regulation that requires an insurer to delay coverage after acceptance of a premium, nor could the insurance agent provide me with a citation to this regulation. Based on this information and the lack of contact with Carrington regarding the damage sustained, reimbursement by UWM for the costs associated with these repairs is not warranted,” Link wrote.

John Gregory says he did try and report the damage to his insurer, who found no record of his policy because of the error.

“That was all after the hurricane. So the damage is already done. So what do you — what good is that? They need to step up and do what's right and quit all this jockeying around,” John Gregory said.

It’s unclear if there will be any further resolution, but this could be a reminder for homeowners less than 50 days out from another hurricane season. If your mortgage is sold to another lender, double and triple check there’s no lapse in your insurance coverage. If you sustain damage to your home, contact both your insurance company and mortgage lender to report the damage.

The state Office of Insurance Regulation has resources for people dealing with claim issues. You can check out the state's Insurer Consumer Advocate here.